AUTO FINANCING MADE EASY. GET PRE-APPROVED ONLINE.

APPLY IN SECONDS

WE’LL FINANCE YOU IF THE BANKS WON’T

WE’LL RE-FINANCE YOU IF YOUR RATE IS TOO HIGH

THE FINANCING PROCESS

We help you find

a vehicle you love

Once you fill out the form above, our team of personal shoppers will search far and wide for the exact vehicle you want, right down to specific features.

Get pre-approved

online

Now that you’ve decided on a vehicle, we can get you pre-approved for it without having to bring you into a dealership. Get approved in your pj’s!

Low/no credit?

No worries

We work with more than a dozen banks to secure the auto financing you need. But even if they deny you, My Mississauga Chrysler can still finance you-with our own money.

Pick your

payment

Once you’ve been approved we work with you to choose a payment that fits both your lifestyle and your budget.

HOW WE’VE APPROVED MORE THAN 300,000 PEOPLE

Bad Credit Car Loans

If you’re facing challenges getting approved, My Mississauga Chrysler has solutions for almost every credit situation. Our financing tools and credit specialists will help you get back behind the wheel with affordable auto loans.

In-House Financing

My Mississauga Chrysler offers convenient in-house financing solutions that will get you on the road fast. We report our loans monthly to the major credit rating suppliers in Canada so your creditors know you have a car loan in good standing.

Our Finance Partners

We also work with other world-class financial institutions to give our customers access to the best car financing rates and the widest variety of options.

OUR EXTENSIVE LIST OF LENDING INSTITUTIONS INCLUDES:

- Alberta Treasury Branch

- Bank of Montreal

- Bank West

- Chrysler Financial

- Carfinco

- Ford Credit

- FinancialLinx

- First Calgary Savings

- Royal Bank

- Scotia Bank

- Scotia Dealer Advantage

- Servus Credit Union

- TD Canada Trust

- VFC

- WS Leasing

- Dominion Leasing

OUR CAR LOAN SPECIALTIES

No Credit

Buying a new car is a great way to establish a credit score, and My Mississauga Chrysler can help you get credit for the first time. Stop waiting and get on the road.

Bad Credit

Our finance sources provide offers to accommodate most credit profiles. Even with past problems, you will still get the credit you need, the car you want, and the respect you deserve as a My Mississauga Chrysler customer.

First-Time Buyer

Many My Mississauga Chrysler Customers qualify for financing on their very first purchase. Even if this is the first time you’ve bought a car, we can offer you a number of options.

Financing Benefits

Being the biggest auto group in Canada, we have the ability to set up our own financing solutions in order to help our customers get driving. You could say we set our own rules.

ESTIMATE YOUR CAR PAYMENTS

Loan Calculator

Please fill out the information below.Payment

FINANCE VS LEASING: WHICH IS BETTER?

What are your goals? We all have different priorities — in cars, life, and finances. When deciding on leasing vs. financing, what’s right for one person can be totally wrong for another.

Generally, leasing offers lower monthly payments than financing, as well as the benefit of owning a new car every two or three years. However, financing offers its own set of advantages.

Luckily, we have a team of financial experts who are happy to help you find the best option for you. Call My Mississauga Chrysler at 289-806-4956 to book a free consultation.

Is leasing better for me?

You Want

To drive a new car every two or three years

Lower monthly payments

The latest safety features and a car always under warranty

You Don’t Mind

Trading in or selling used cars privately

Building ownership equity

You Have

A stable, predictable lifestyle

An average number of miles to drive

No problem properly maintaining your car

If this sounds like you, then leasing may be the best option for your needs

Is financing better for me?

You Want

To build up trade-in or resale value (equity)

Complete ownership of your car

The feeling of being payment-free after paying off your loan

The freedom to customize your car

To drive your car for a long time

You Don’t Mind

Unexpected repair costs after your warranty has expired

Higher monthly payments

You Have

To drive more-than-average miles

Possible lifestyle changes in the near future

If you prefer to own your vehicle outright, and plan to own for the long-term, then financing will be your best option

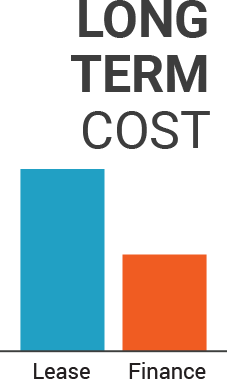

FINANCE VS LEASING: COST COMPARISON

For the same car, same price, same term, and same down payment, monthly lease payments will always be 30%-60% lower than loan payments. This is still true even when compared to 0% or low-interest loans.

The medium-term cost of leasing is about the same as the cost of financing, assuming the buyer sells or trades his or her vehicle at loan-end and the leaser returns his or her vehicle at lease-end.

Some comparisons sometimes show that financing can cost a little less than leasing due to fewer fees, lower total finance costs, and the assumption that a purchased vehicle will return full market value if it is sold or traded at the end of the loan. However, when the benefits of wisely investing monthly lease savings are considered, the net cost of leasing can be less than financing.

The long-term cost of leasing is always more than the cost of financing, assuming the buyer keeps his vehicle after loan-end. If a buyer keeps his car after the loan has been paid off, and drives it for many more years, the cost is spread over a longer term. That means the cost of buying one car and driving it for ten years is less expensive than leasing or buying four or five different cars over the same period.

If long-term financial cost savings were the most important objective in acquiring a new car, it would always be best to buy the car and drive it for as long as it survives, or until the cost of maintenance and repairs begins to exceed the cost of replacing it. However, many automotive consumers have other more immediate objectives that are more important than long-term cost savings.